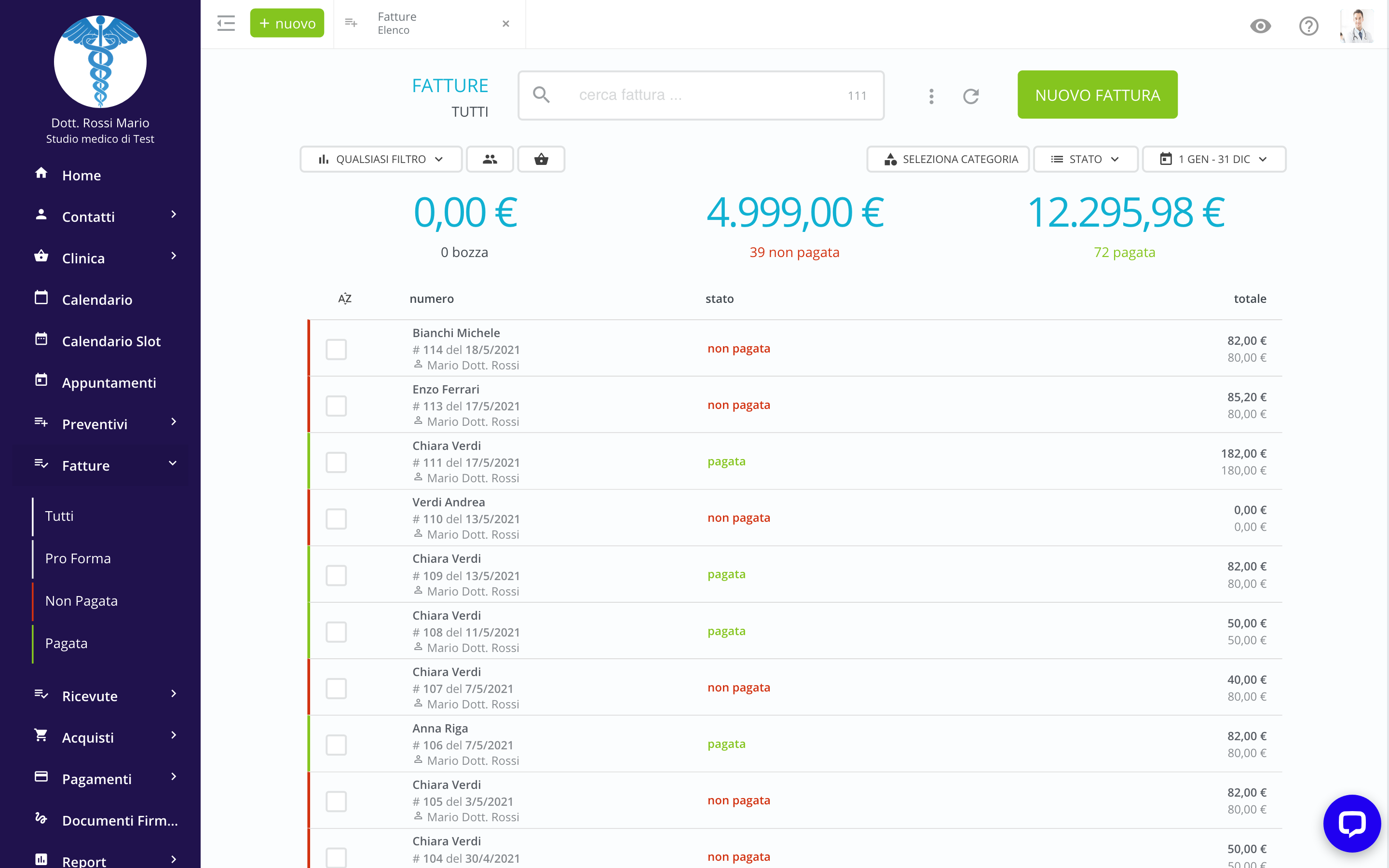

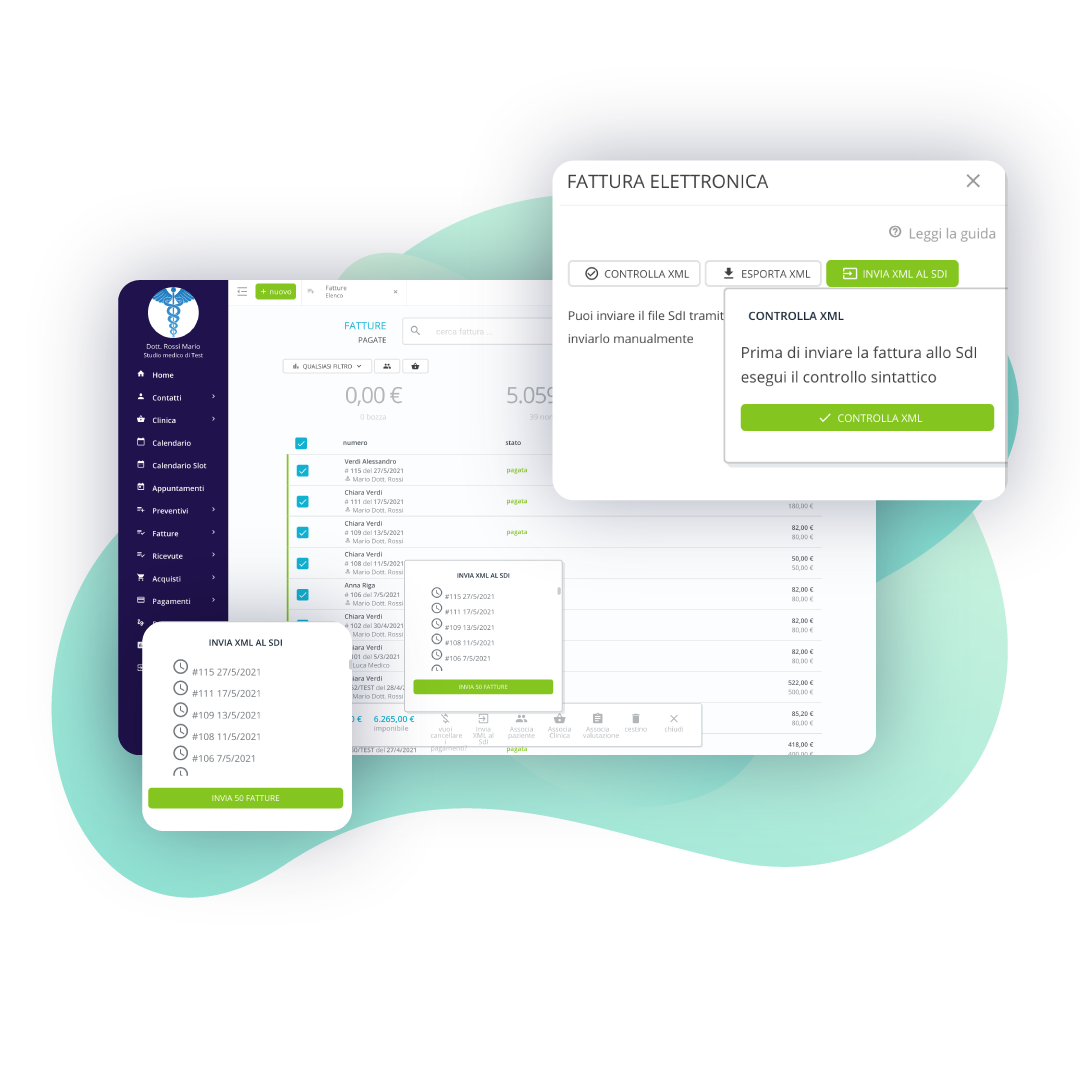

Send all your electronic invoices to the Agenzia delle Entrate - tax agency - in a fast and easy way

Send all the documents to SDI with only one click

Don't let others do this easy and simple task, with only a couple of click you can have everything under control

0K

0K

0K

0M

Questions

Which intermediary uses Beebeeboard?

The intermediary is a subject who sends and receives files on behalf of the economic operator and / or public administration.

- If the Intermediary is authorized to transmit the files to the Administrations on behalf of third parties, consult the Economic Operators section

- If, on the other hand, he is authorized to receive files on behalf of the Administrations, consult the Public Administrations section.

Beebeeboard uses Trust Technologies as an intermediary for sending and receiving the documents.

Where can I find the electronic invoices received?

All the electronic invoices, both active and passive, will be always available in your taxation drawer, but they will be visible and accessible also in Beebeeboard. The letter E highlight the fact that it is an electronic invoice and therefore no longer modifiable.

How do I create an electronic invoice?

All practical and technical procedures are delegated to Beebeeboard, the user creates a normal invoice that will already have all the information necessary to be transformed into the XML file requested by the Tax Agency

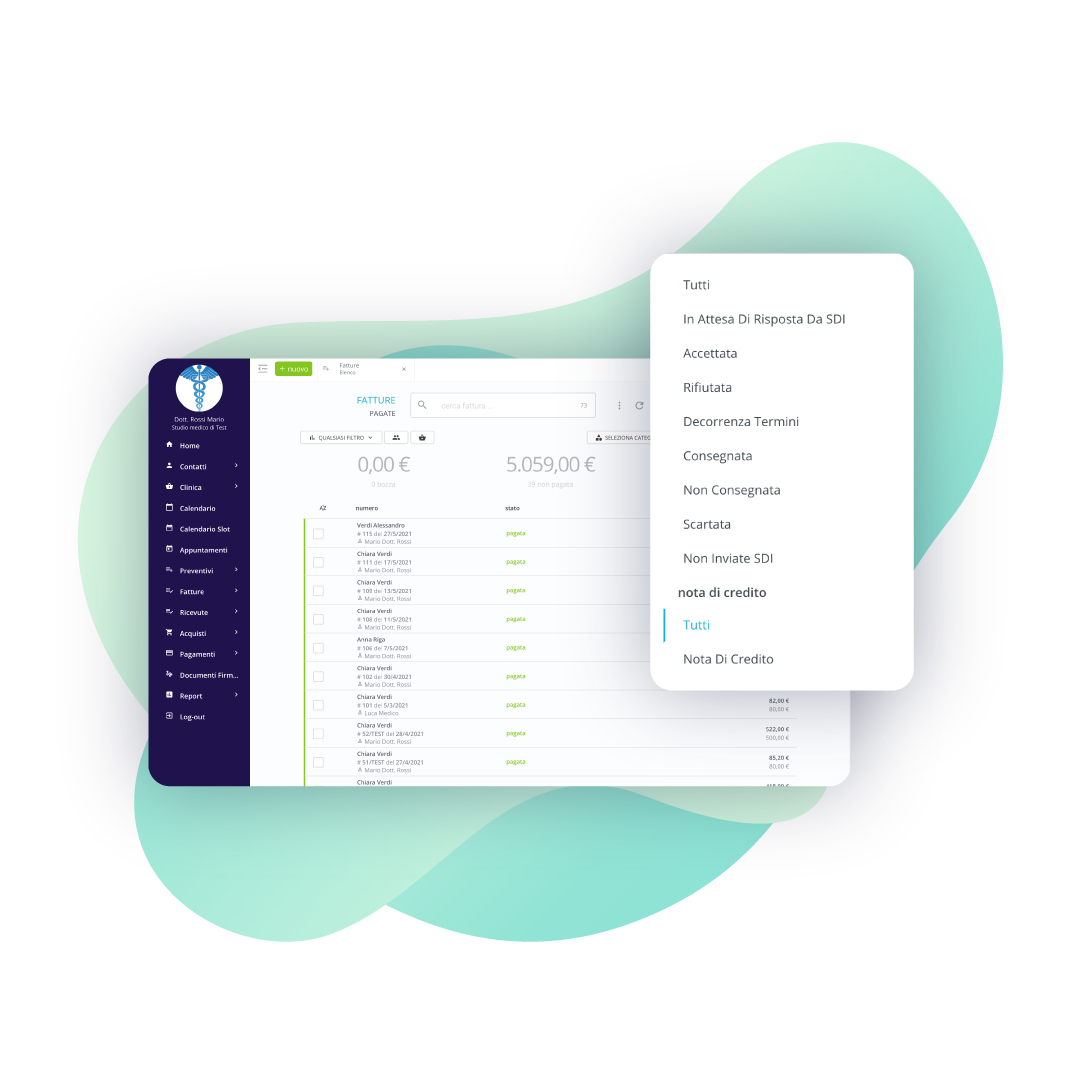

How to cancel an electronic invoice that has already been accepted?

We do recommend to make a Credit Note for that invoice. The Credit Note will also be sent as an electronic invoice and will effectively cancel the previous document

Does my Unique Code change?

Yes, the unique code is a code used by SDI to find out which channel to use to deliver the documents.

By enabling Beebeeboard electronic invoice service you will receive a new unique code that you will have to set in your fiscal drawer in this way no invoice will ever be lost and it will not be necessary to communicate the new code to all suppliers

Who is exempt from issuing an electronic invoice?

Only operators (businesses and self-employed workers) who fall within the so-called “advantage regime” (pursuant to art. 27, paragraphs 1 and 2, of the decree-law 6 July 2011, n. 98, converted, with amendments, by law no. 111 of 15 July 2011) and those falling within the so-called “flat-rate regime” (pursuant to art. 1, paragraphs 54 to 89, of law no. 190).

Attention Operators with a benefit or flat-rate regime can still issue electronic invoices following the provisions of the provision of 30 April 2018. To these categories of operators can be added the “small agricultural producers” (referred to in art. 34, paragraph 6, of Presidential Decree no. 633/1972), who were exempted by law from issuing invoices even before the introduction of the obligation of electronic invoicing.